social security tax definition

Your benefits are not taxed if your income falls below 32000 married filing jointly or 25000. Replacement Social Security Card Check Application or Appeal Status People Helping Others Contact Us Forms Publications Calculators Social Security Statement Direct Deposit Closings.

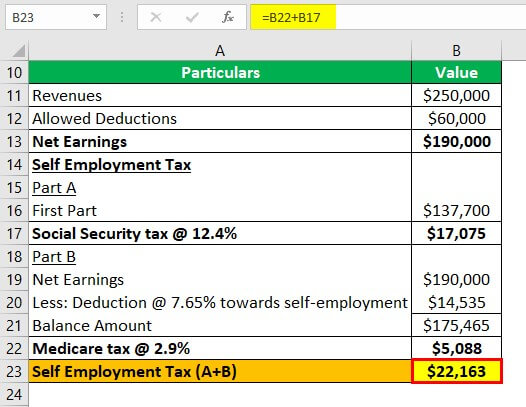

Self Employment Tax Definition Rate How To Calculate

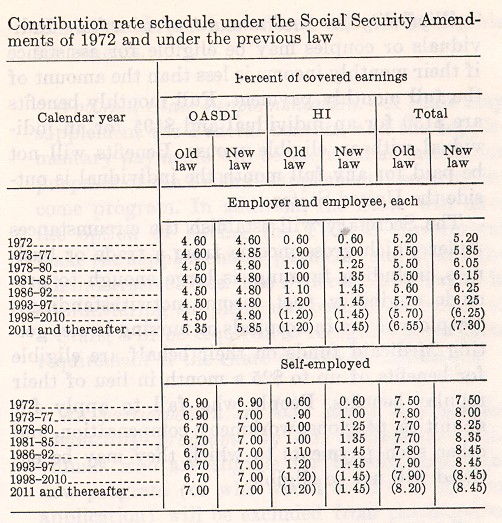

Social Security is funded by a special 124 tax paid by employers employees and self-employed individuals.

. Define Social Security Taxes. Social Security benefits are included with other taxable income at the rate of 85 50 or zero. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income.

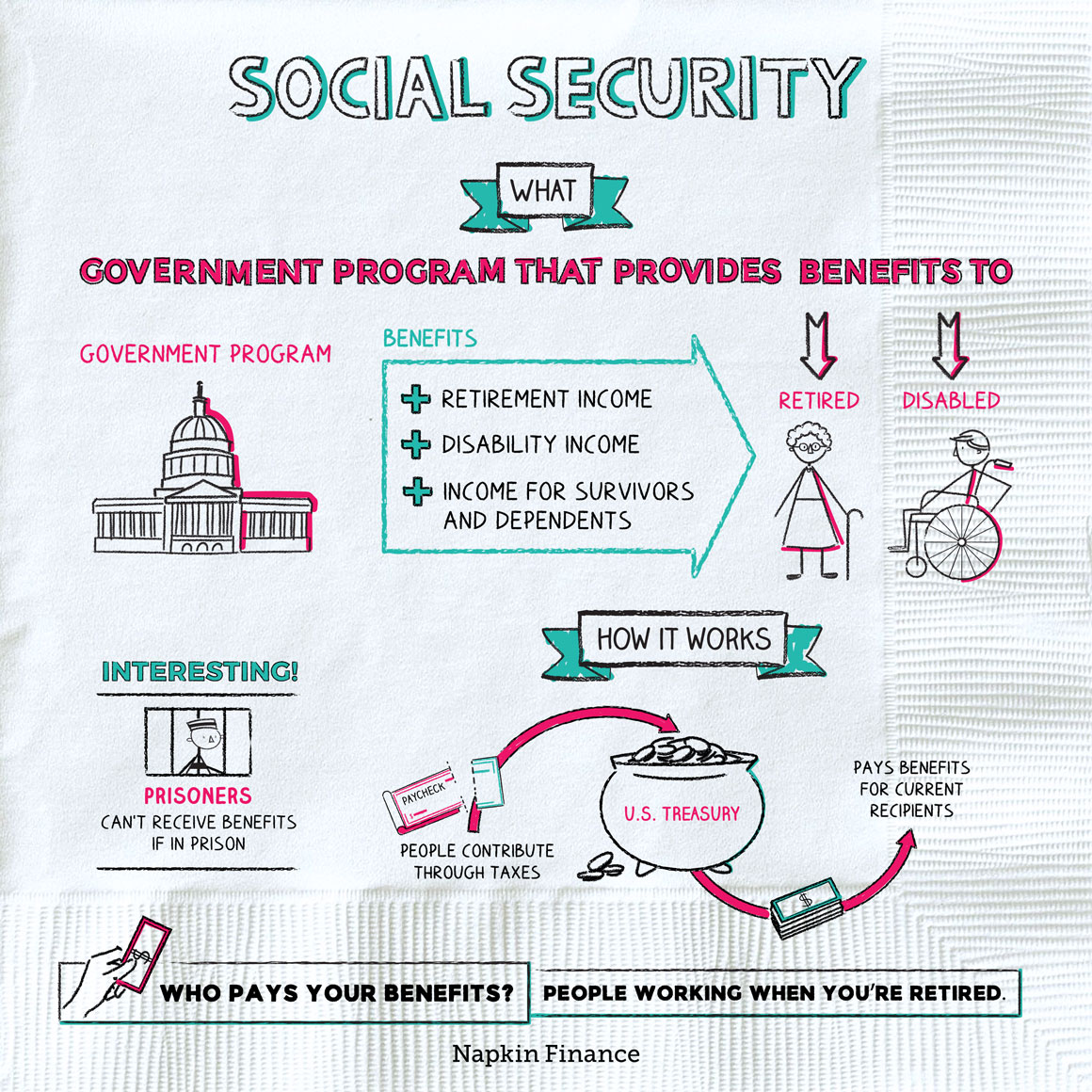

A United States federal program of social insurance and benefits developed in 1935. Social Security was intended to provide financial security to retired seniors disabled persons and surviving spouses of those who at one time worked and paid Social Security taxes. In 2022 the Social Security tax limit is 147000 up from 142800 in.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. You will pay 10 percent on taxable income up to.

Between 25000 and 34000 you may have to pay income tax on. Often Social Security Abbr. Fifty percent of a taxpayers benefits may be taxable if they are.

The Social Security programs benefits include retirement income disability income Medicare. Refer to Publication 15 Circular E Employers Tax Guide for more information. If youre a single filer in the 22 percent tax bracket for 2023 you wont pay 22 percent on all your taxable income.

As of 2021 a single rate of 124 is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of 142800. Social Security is a federal program that issues benefits to retirees and disabled workers based on their age and work history as well as to beneficiaries family members and survivors if they meet certain eligibility requirements. Each year the federal government sets a limit on the amount of earnings subject to Social Security tax.

First recapture taxes penalties and other taxes related to retirement plans to the underpayment of estimated tax to uncollected employee social security tax on tips and on group-term life. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your Social Security benefits depends on your income level.

Social Security and Medicare Withholding Rates. Shall include any Taxes imposed pursuant to the Federal Insurance Contributions Act under section 3101 et seq. Overpayment of Social Security or Supplemental Security Income SSI benefits Excess earnings Voluntary income tax withholding Payment of your appointed representative.

Money collected from employers and employees by the government to pay people when they retire or. Half this tax is paid by. Social Security Tax synonyms Social Security Tax pronunciation Social Security Tax translation English dictionary definition of Social Security Tax.

Social security tax meaning.

Social Security Congressman Tim Walberg

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About Fica Social Security And Medicare Taxes

What Is A Resident Alien H R Block

Paycheck Taxes Federal State Local Withholding H R Block

Self Employment Tax Everything You Need To Know Smartasset

Social Security Benefits Expat Us Tax

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Podcasts For Your Clients American Century Investments

What Is A Tax Liability Ramsey

What Is Social Security Tax Calculations Reporting More

What Is A W 2 Form Turbotax Tax Tips Videos

What Is The Social Security Tax And How Much Is It Thestreet

Taxes Payroll Taxes Especially Social Security Are Regressive Not The Homa Files

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate

U S Tax Return Definition Sections Faqs A Speedy A Z Guide

What Are Social Security Benefits Social Security Faq What S Social Security